mass tax connect certificate of good standing

Follow prompts entering the appropriate information. To create your MassTaxConnect account follow these steps.

Massachusetts Sales Tax Small Business Guide Truic

Select the Delete My Profile hyperlink in the Access section to cancel your current username.

. Return to Mass Tax Connect and chose Find a request under Quick Links. View Sample of Certificate of Good Standing Please submit the certificate to ETPLMassMailStateMAUS. 62C 51 52 GL.

Please enable JavaScript to view the page content. Payments in MassTaxConnect can be deleted from the Submissions screen. Expedited service is available for.

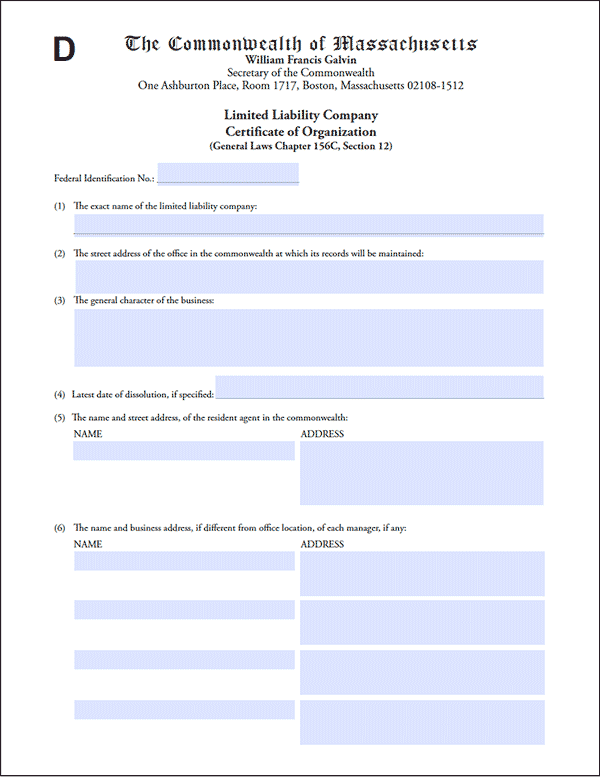

Name of transferee Date of transfer or sale Street address CityTown State Zip. As authorized under GL. Official websites use massgov.

Payments that have a status of In Process or Completed cannot be deleted. The payments must have a status of Submitted to be deleted. You can then reregister creating a new username to gain access to your tax accounts.

Full-year resident taxpayers who have previously filed a Massachusetts return are eligible to file an income tax return on MassTaxConnect for free. Ad Apply For Your Certificate of Good Standing. How to File for a Certificate of Good Standing When You are Logged In.

The Annual Certifications of Entity Tax Status as of January 1 of each year must be filed on or before the following April 1. Name of organization Trade name or DBA Federal ID or Social Security number. Obtaining Good Standing Certificate in Massachusetts.

If you need a new username. Shortly after April 1 2021 the 2021 Corporations Book will be released online to assist local boards of. Log in to MassTaxConnect.

Online processing costs 15 and the certificate will be emailed to you the same day. For further information call 617 887-6367. A MA Good Standing Certificate is often required for loans to renew business licenses or for tax or other business purposes in the state of Massachusetts or in any other state.

138 64 and GL. To delete a payment i f the payment was made while logged into an MassTaxConnect account. For additional help please view our MassTaxConnect Video Tutorials.

A Certificate of Good Standing-Tax Compliance or a Corporate Tax Lien Waiver is the answer when individuals corporations and other organizations need proof theyve filed their tax returns and paid tax bills in order to. Navigate to the S earch S. Certificate of Good StandingLetter of Compliance Certificate of Good Standing for a Non-Profit Organization Waiver of Corporate Tax Lien If requesting Waiver of Corporate Tax Lien attach price and legal description of assets to be sold and complete the following.

By obtaining a Certificate of Good Standing you can be sure that your business has satisfied its annual report franchise tax and other obligations. When completing this form be sure to print legibly. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

How to applyCreate your MassTaxConnect individual account. It will also be available to download from MTC_ Instructions to. Your support ID is.

The Certificate of Good Standing will be mailed to the address provided below. For example the certification of your companys status as of January 1 2021 must be filed by April 1 2021. Enter the email you used in Step 3 along with the confirmation code from Step 5 and click on Search.

Normal processing takes up to 5 days plus additional time for mailing and costs 12. Complete in Just 3 Steps. Your support ID is.

You can order a certificate of good standing in the Commonwealth of Massachusetts by mail in person or online but we recommend online. Please enable JavaScript to view the page content. For example the certification of your companys status as of January 1 2021 must be filed by April 1 2021.

A Certificate of Good Standing from DOR is required for Training Providers to meet DOR compliance. Provide us with some basic information about your company and. Massachusetts Certificate Tax Form.

Click Create my username Select I am an individual who has previously filed taxes in the state of Massachusettsclick Next and then. Once your business remains compliant with the state you can request a Massachusetts certificate of good standing from the Department of Revenue. Get and Sign Massachusetts Certificate Tax Form.

The following is a compilation of frequently asked questions about different aspects of MassTaxConnect. Most states want to see a certificate of good standing or its equivalent before allowing a company to do business in that state as a foreign entity process called foreign qualificationCompanies that intend to expand abroad might also need to obtain certificate of good standing and then certify it for foreign use either. Avoid The Hassle and Order Your Certificate of Good Standing.

One of the most common reasons that ypu might need a MA Good Standing Certificate is to apply to do business in a state other than Massachusetts. However full-year resident taxpayers who have previously filed a Massachusetts return are eligible to file an income tax return on MassTaxConnect for free. The Foreign or Domestic company must be registered as a legal entity with the Massachusetts MA Secretary of the Commonwealth MA Corporation MA LLP or MA LLC.

This can be done online by mail or by fax. How do I delete a payment. 156D 1532 the Collections Bureau with the Operations Division issues the documents of goodtax standing described below.

Order Your Massachusetts Certificate of Good Standing. Select the Manage My Profile hyperlink in the top right section of the Home panel. In order to be in Good Standing a Massachusetts Corporation or LLC must be in compliance with the following.

Corporations and other organizations often need proof that they are in good tax standing with the Commonwealth ie that all tax liabilities have been met. Revenue PO Box 7066 Boston MA 02204 or fax to 617 887-6262. The filing fee is 125 for corporations and 500 for LLCs.

Surprise Your Online Seller Doesn T Collect Sales Tax But That Doesn T Mean You Don T Owe It Opendor

Llc Massachusetts How To Start An Llc In Massachusetts Truic

Sales And Use Tax For Businesses Mass Gov

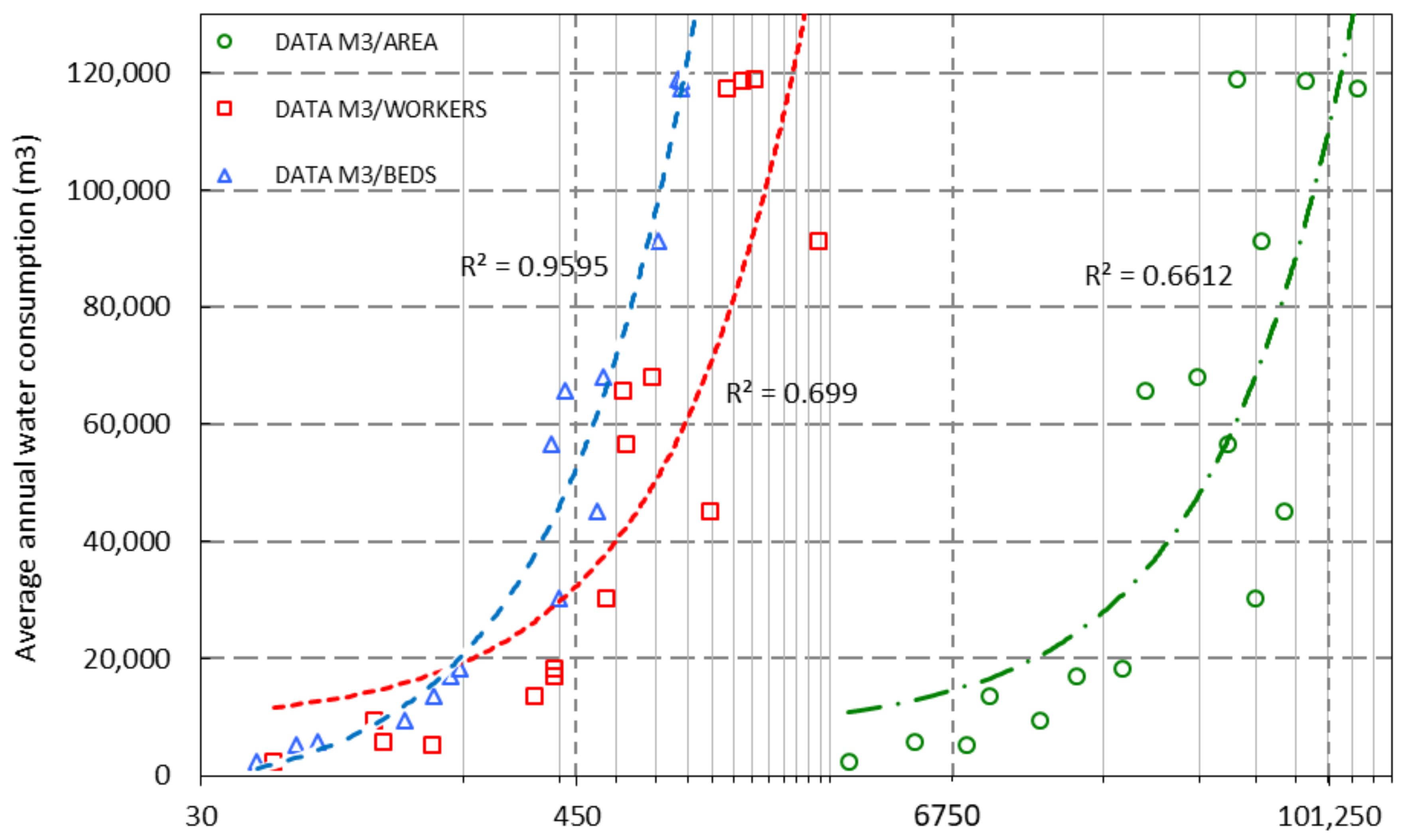

Sustainability Free Full Text Quantitative Determination Of Potable Cold Water Consumption In German Hospitals Html

Massachusetts Short Term Rental Tax Guide Weneedavacation Com

Guide To The Department Of Revenue Your Taxpayer Bill Of Rights Mass Gov

Certificate Of Good Standing Massachusetts Truic

How To Log In To Masstaxconnect For The First Time Youtube

Belectric Solar Energy For A Green Future Belectric

European Flag European Commission Strasbourg 8 6 2021 Com 2021 301 Final Report From The Commission To The European Parliament The Council And The Court Of Auditors Annual Management And Performance Report

How To Get A Certificate Of Good Standing In Your State Forbes Advisor

How To Log In To Masstaxconnect For The First Time Youtube

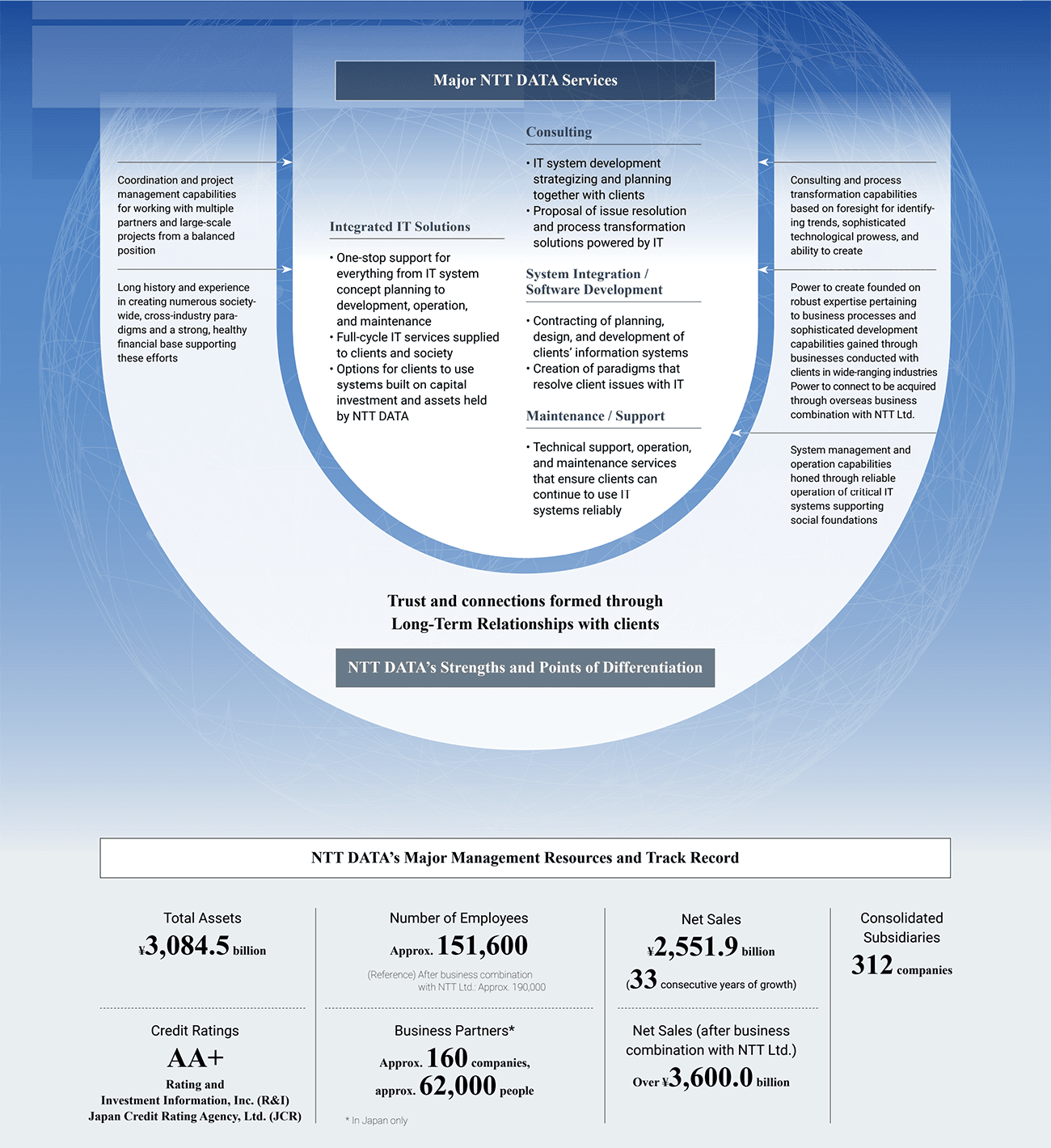

About Us Home Page About Us Ntt Data

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto